10 Steps to Take After Your Insurance Denies an Insulin Pump or CGM

If you haven't already listened to D-Mom and volunteer insurance advocate Samantha Arceneaux on the Juicebox Podcast go ahead and click play on that player you see below. -- Sam is a never ending font of information on how best to appeal your insulin pump or continuous glucose monitor insurance denial and she was kind enough to write this guest post for Arden's Day. The mother to Mikayla a T1 5 year old diagnosed at 22 months old, Samantha has spent the last several years as a volunteer diabetes insurance advocate, helping other parents fight insurance companies for insulin pump and CGM coverage.

Sam is brilliant and these are her 10 steps to take when you've been denied by your evil overlords (medical insurance company).

guest post

Steps When Being Denied by Your Insurance:

- Did you receive a denial letter? If not, investigate to find out why. Was the supplier incorrect? Were they in-network?

- Double check your pharmacy benefits to see if you can gain the item that way.

- If it’s a company plan, ask your HR department if they might be able to override the denial.

- Ask your doctor to complete a peer-to-peer review with the insurance company.

- If still denied, ask the doctor for a letter of medical necessity.

- Look at why they are denying, then compare against your medical records and the insurance’s medical/clinical policy or guideline. Find if they incorrectly applied their policy to your situation, or if they are using outdated data.

- Do your research. See if there are new studies that prove your medical request is supported by professional recommendations or research studies. Aim to have 2-5 relevant studies/statements.

- Go for the appeal. Insurances want a medical need established and why it (the item being requested) has the potential to lower their costs. It cannot be emphasized enough, what you put into it is what you can expect to get out of it.

a) Include what the system/supply does medically in a few short sentences, don’t assume they know. It will make the rest of your arguments more effective if they understand the concept behind the device/supply.

b) A modicum of formality can be helpful as well, as the insurance will be unsure of who actually wrote it; was this the patient, an advocate, an attorney, a doctor? It may imply to the insurance reviewer that you are not going away easily.

c) Fight against any outdated research the insurance uses in their medical policy, or if they failed to gather/review your medical data that supports your need for the device/supply.

d) Quotes from the research studies or statements are helpful, since they will not be looking up the studies themselves. Paraphrasing is also encouraged. Just remember to cite the study/professional organization each time.

e) Give real life examples on how this device/product can help you (refrain from convenience examples). For instance, do not talk about how a CGM can be remotely viewed and how this saves the hassle of checking in with your child. Rather, talk about how the device alerts you to rapidly changing glucose values so that you can take steps to prevent a crisis from - So you win the appeal and get approval. I strongly advise getting it in writing before you order the supply/device. This will be your evidence in the event something isn’t properly posted in their system, such as length of approval (should be for 1 year).

- If you do not overturn the denial on appeal, try again. Typically you will have two internal reviews that are done by the insurance companies before going on to the external review. The external review is completed by independent reviewers and tends to be more impartial, which means a higher chance of getting approved. (Medicaid/Medicare products may have more levels of appeal available).

Other useful information:

For non-covered items: You will need to request a formulary exception. This means that you recognize that it isn’t a covered product but still feel that it is medically necessary and should be covered by your insurance. Treat this as an appeal situation.

For non-preferred items: If a drug or supply is non-preferred, you will ask for a tier exception. This is basically where you give the insurance company a medical reason why you cannot utilize the preferred item and ask that they give you the non-preferred item AT the preferred rate. This typically is a pharmacy situation.

Visit Sam's blog to read her other detailed information regarding insurance denials. Sam rocks!

OmniPod Recycling Program

Recycle your OmniPods for Free with no shipping cost to you - just contact customer service to get started.

Do you hate feeling like you're adding to a giant landfill? Have you ever found yourself wishing that you could be more responsible with all of those Pods that end up in the trash?

Well, you can and everything you need to know is right here...

"Find out how the insulin Pod program works. See just how easy it is to participate. Learn why bio-hazards are particularly costly to recycle. Above all, sign up by calling our Customer Care Team at 800.591.3455 and choosing prompt 2. Just click the links below to find out more and start saving your insulin Pods."

How to dispose of your insulin Pods—the earth-friendly way

Eco-Pod Program FAQs

We've been recycling Arden's pods for years, you can too! Save the planet, save your guilt... recycle a pod.

What!? You don't use OmniPod? Get a free Demo pod and check it out!

Having a Happy Thanksgiving with Insulin

What do you think about when I say the words mashed potatoes, stuffing or pumpkin pie?

Most people hear those words and think "mmmmmm, it must be Thanksgiving" but some of us immediately begin to wonder how many carbohydrates are in stuffing. Many of the people who live with or care for someone who lives with diabetes, begin to panic. Instead of family and football they begin to think about Thanksgiving as a day that is trying to defeat them, they immediately feel stress and either decide to, sort of just give up and "do their best" or search for the measuring cups focused on getting the carb counts of every tasty Thanksgiving treat exactly right. In my opinion; there is a better response.

When I'm giving my daughter Arden insulin at a meal I focus on two things - How insulin works in her body and about how many carbs are in the food she is eating. In an effort to keep this, if you'll pardon the pun, digestible... I'm going to break this post into individual thoughts on subjects.

Questions I ask myself before I begin...

Is it more important to know A. exactly how many carbs are in a scoop of potatoes or B. how long it takes for insulin to begin to effect the blood sugar and how long it lasts in the body? - Answer is B

Will the day include a lot of grazing, am I planning for set meal times or is it both?

Do I have a reasonable understanding of the amount of carbs in the foods that will be consumed?

Am I afraid of insulin? - Be honest with yourself

My Goals...

My blood glucose goals for Arden are simple, yours should be too...

I am trying to maintain the steadiest blood sugars as I possible can. I want to avoid spikes and significant lows.

I consider a BG over 150 (after food) a high blood sugar.

I do not want Arden's BG to fall below 75 but steady at that number is a huge win, especially today.

For CGM users: I don't want to see arrows pointing straight up or straight down. If I do, I've mistimed insulin, miscalculated carbs or (for pump users) would have benefited from extending my bolus. When we were non CGM users: If Arden's BG is above 150-160 forty-five minutes after your mealtime bolus, you probably didn't use enough insulin. More insulin, more testing.

I want to create a stress free, carefree and happy day without frying my brain.

Insulin...

I have two steadfast rules about managing my daughter's type 1 diabetes. Read them, memorize them, live by them.

1. It is far easier to stop a low or falling blood glucose then it is to return a high blood sugar to a safe range. In my experience most low or falling BGs can be stopped and steadied in a short amount of time, maybe 15 minutes. A high BG can take 3 to 5 hours to return to a safe place. I'll say it again. It is easier to stop a fall or a low then it is to effect a high. This thought guides everything I do with insulin.

2. If Arden's BG is high any time after a meal (140-150), I did not use enough insulin at the correct time. Two VERY important considerations in this sentence, they are AMOUNT of insulin and the TIMING of the bolus relating to when food consumption begins.

Before we move on I want to say this, these are my rules but you know as well as I do that diabetes will, on some random day, act in no way like you expect. That is a fact of living with manmade insulin. I refuse however to allow the fear of that random day to make me except high BGs on all of the other days. I would rather battle a low a few times a month then live with a daily average BG that is any higher than it needs to be. Bold with insulin!

Lets talk about giving insulin for a meal...

There are generally one of three situations I experience before a meal. 1. A higher BG then I want, 2. A lower BG then I want, 3. A BG in our comfort range. All of these may be steady, rising or falling.

Let’s have some examples:

Step one for each possible situation is to pre-plan. Don’t start thinking about insulin at 4:55 if dinner is at 5, if that’s what you are doing... I’m willing to bet you see a lot of high BGs after food.

If our dinner is at 5 pm, I want to find out what Arden's BG is at 4 pm.

If Arden’s BG is 160 at 4 pm I would bolus for the 160 with the goal in mind of getting it as close to 90 as I could by 4:45 pm because (in this example) at 4:45 pm, I am bolusing for dinner. Here’s me counting carbs. Scoop of potatoes… eh 30. turkey 0, gravy, let’s call that 7, probably have two dinner rolls… I’ll call that 30, corn lets say 10, green veggies nothing. Okay that’s about 80, how much insulin is 80 carbs? Last thing I do is ask myself if the amount of insulin that 80 carbs indicates sounds like enough or too much? “Sounds like” means based on my past experiences with similar meals. If it doesn’t, I adjust it manually. One way or the other I’m hoping to have a 90 BG 15 minutes before the meal begins and I am bolusing with the thought that the mealtime insulin (In Arden) won’t begin to work for at least 15 minutes. The goal is for her BG to be 80ish when two things happen. 1. Her mealtime insulin begins to work and 2. The carbs from the food begin to have an effect on her BG. I want these things to happen at the same time when her BG is around 80. Then I watch the struggle between insulin and carbs play out on her Dexcom CGM. Most times this results in no spike and a steady BG for the next two hours. Adjustments (In Arden) may be needed around the two hour mark. More insulin, some carbs… one never quite knows.

A steady and in range BG gets the same pre bolus. Again, I want the struggle between the carbs and insulin (insulin pulling the BG down, carbs pulling it up) to happen as close to the 70-80 range as possible.

If Arden’s BG is low or falling an hour before dinner I only want to bump it ever so slightly. I don’t want it rising or high at 4:45. On the lower side is a great way to approach a meal - But you still have to pre bolus. I can’t say to myself, “her BG is 80 at 4:45 pm so I can’t pre bolus”. I have to trust the process, I have to trust that new insulin won’t cause a low for at least the amount of time that I believe it takes for the pre bolus insulin to begin working.

In the end, I can count the amount of times on one hand that a meal has gone well without a significant and well timed pre bolus. Only you know how long it takes for insulin to begin working in you or your child, so adjust accordingly with great deference to how long it takes the food to begin to effect the BG.

Remember, it is easier to effect a low than it is to correct a high....

I know there is a ton of other variables that I haven’t discussed. What if my child is too young to properly assume how much they will eat… in that situation I'd pre bolus half and then get the rest of the insulin in as soon as I could confirm that the food will be eaten. Easier with a pump sure, but even when you are injecting... it’s either two shots at dinner or one shot at dinner and another an hour later while you are battling a 300 BG. Which sounds better to you?

Arden has a CGM which makes all of this so much easier. I can see when she’s falling 5 minutes before we eat and hand her a roll. I can see the speed and direction that her BG is moving. No doubt what I am talking about is easier with a CGM but it is not impossible without one. Pre bolus (or inject), test 45 minutes later, test again 2 hours later. Stay on top of the BG.

Don’t fall prey to the drama! Don't ell yourself that, “I did what the endo told me” or “I counted the carbs, what else can I do”. That's all bull%$#&. You can do plenty with a positive attitude and a calm reaction to the things that don’t go as planned. Keep it easy in your mind; BG too high, need more insulin. Too low, need more carbs.

Is it a grazing day? Try using a temp basal rate. Perhaps an increase of (maybe) 30% to start, then adjust as needed. Don’t be afraid to let it run all day and don’t forget that the effects of a new basal rate may not be visible on a BG for 30 minutes to an hour. Also, when you stop a temp basal, it will take that much time to return to a level that you are accustom to.

I won’t let a BG that has gotten crazy high ruin Arden’s day... I crush it with insulin. Then test often or watch my CGM closely - sometimes both. If it falls too far or too fast, I catch the fall with a fast acting liquid carb. I give myself enough time to treat the fall without having to over treat - stay off the rollercoaster! Sometimes the hardest thing to do is to just wait and retest, I know, but that is how you will avoid chasing highs and lows all day. At some point you have to say to yourself, "we need to find a plateau and start over".

Last things and this is important. Lots of insulin is going to be used today. Watch your overnight BGs closely. Look for lows, unexpected falls and even high BGs from those carbs that just won’t digest and be gone. No telling which reality you’ll experience over night. Best to be on the look out. Give yourself a chance to battle on a level playing field, don't begin Thanksgiving with a pump site that is failing or on it's way out. Get your tech going and stable before the stuffing hits the table.

Wishing your family a very Happy Thanksgiving… don’t forget my disclaimer nothing you read here today is to be taken as advice, medical or otherwise. I’m just telling the story of how I manage my daughter’s BGs. Okay, thats enough diabetes talk for me today, I have to got make the stuffing!

Go kick some carbs right in their ass! You can do it...

OmniPod Needle Mechanism May Fail to Deploy

The post title has been edited to remove the phrase "voluntary recall" because I mistakenly used the phrase. This is not a recall, voluntary or otherwise - it is a Field Safety Notification. My apologies to all. - Best, Scott

from Insulet

Insulet Corporation

November 2, 2015

URGENT: Field Safety Notification

OmniPod® Insulin Management System

Certain OmniPod Lots Specified Below

Dear Valued Insulet Customer,

Insulet Corporation, the manufacturer of the OmniPod Insulin Delivery System, is committed to keeping you and your healthcare professionals up-to-date in the event there are any issues that arise related to our products.

As part of our product quality monitoring process, we have identified that 15 lots of OmniPod which were distributed in the U.S. had a slight increase in the reported cases in which the Pod’s needle mechanism failed to deploy or there was a delay in the deployment of the needle mechanism. The reported incidence of this product issue in the affected lots is approximately 1%-2%. Once we recognized this, we corrected the manufacturing process and implemented additional inspection steps.

No serious injuries or deaths have been reported in patients using OmniPod devices from the affected lots.

How do I know if I have affected product?

This Field Safety Notification affects only the Pods and does not affect the OmniPod Personal Diabetes Manager (PDM). The slight increase was identified in the following lots of Pods:

The lot number is located on the Pod tray lid label, the side of the Pod and on the end of the box of Pods.

What is the risk?

In the event a needle mechanism fails to deploy, the needle will not be inserted and insulin delivery will not begin. The interruption of insulin delivery may cause elevated blood glucose (hyperglycemia), which, if left untreated, can result in diabetic ketoacidosis (DKA). If you believe you have successfully activated your Pod and you experience unexpected elevated blood glucose levels, please consult your healthcare professional.

Upon activation, how do I know if the needle mechanism deployed?

After you press the Start button on the PDM, you should hear a few soft clicks and then a louder click from the Pod indicating that the needle mechanism has deployed. If you do not hear this within a few seconds after pressing Start, the Pod has failed to deploy.

You should also feel the insertion of the needle mechanism deployment. The PDM will indicate that the Pod is active and prompt you to check to ensure the cannula is properly inserted (Figure 5-23 in my PDF). For more information, please see the User Guide.

You should always check the infusion site after insertion to ensure that the cannula was properly inserted.

When you see the pink slide insert in this position, it means that the cannula is inserted (See figure in my PDF).

The PDM will automatically remind you to check your blood glucose 1.5 hours after each Pod change. If the cannula is not properly inserted, hyperglycemia may result.

If you experience unexpected elevated blood glucose levels, change your Pod and contact your healthcare provider.You may also call Customer Care at 1-855-407-3729 if you have any questions regarding this Field Safety Notification.

This voluntary action is being taken by Insulet Corporation with the knowledge of the U.S. Food and Drug Administration (FDA). Adverse reactions or quality problems experienced with the use of this product may be reported to the FDA’s MedWatch Adverse Event Reporting program either online or by regular mail or by fax.

We appreciate how you depend on us and sincerely regret any inconvenience this may cause you. We are focused on delivering the highest level of product quality and your complete satisfaction is our top priority.

Sincerely,

Michael Spears

Vice President, Quality, Regulatory & Clinical Affairs

Insulet Corporation

Announcement can be found on the Insulet website with this link.

I see London, I see Florida, I see Arden's Dexcom CGM data

As our children get older our family is sometimes required to split up to accomplish everything on our calendar. You know, our son Cole my have a baseball game on one side of town while Arden has a game three towns over, stuff like that. Kelly and I never like to miss the kids stuff but it happens.

Last week presented us with a twist on that theme when Kelly's job took her to London the day before I was to leave for a Florida based college baseball recruiting weekend with Cole. Kelly left on Wednesday and was returning late on Friday night. I was leaving early Thursday morning and not returning until Sunday evening. Arden had school on Thursday, she was off Friday - okay, you following the set up? Kelly in London, Scott in Florida, one day of school and a day off to cover before Kelly returned home... what ever should we do?

My first inclination was to take Arden to Florida but that would mean her missing a day of school and to be honest, I didn't want to buy her a plane ticket and drag her from one hot baseball field to another, she would not have enjoyed the trip and I wouldn't enjoy spending the money.

Too expensive + too boring + too much school missed = Arden stays home.

The only person available to stay with Arden at our home was my mother and she knows exactly zero about managing type 1 diabetes, but did it matter that she didn't know anything about the day-to-day of type 1? Not if I can see Arden's BG on my phone it doesn't.

I thought about all that could 'go wrong' while I was gone and wondered if I could control the variables remotely, the possible issues that I could image were:

Could Go Wrong

- OmniPod insulin pump could need to be changed (Arden can do this on her own.)

- Dexcom sensor could need to be changed (Arden has never done this but without the Dexcom, none of this works.)

- Overnight (Arden wouldn't wake up overnight if a tugboat crashed into our house.)

- School (I can run school remotely as we normally do... as long as my plane had WiFi)

Plan for Could Go Wrong

- If a pod needs to be swapped Arden will do it but we don't keep insulin at school so I sent Arden to school on Thursday with pods and insulin and wrote to the nurse explaining what was going on. CHECK!

- Having a working Dexcom is the lynchpin to this entire plan and neither I or Kelly can come home if it stopped working. Arden has never changed a sensor by herself. Hmmm, wait... a boy in Cole's grade wears a Dexcom! I called his mother (who I know at best tangentially) and explained the situation. I told her that it was unlikely that Arden would let her try to put a sensor on her but asked if she could be there to oversee if necessary. She rocks and agreed to help if needed! CHECK!

- Overnight what I really needed was an adult to answer the phone and wake up Arden for me, my mom can handle that. CHECK!

- I booked a flight on an airline that has WiFi. Kelly was prepared in London to take over while I was in the air should I encountered a connection issue. CHECK!

Best laid plans and all, but how did it go in the real world?

During my flight

Everything worked out as planned. I woke up early for the plane, made Arden's lunch, counted carbs and packed up her pods and insulin. My mom woke Arden up in the morning, we texted while she was getting dressed to get her BG in place for the morning. The WiFi on the plane was great but we still maintained a multi-person text message thread so Kelly could watch what was happening from London and take over if I dropped out of the thread. We bolused once or twice while Arden was at school that morning, all from 35,000 feet.

I was on the ground for Arden's lunch time pre-bolus and on a ball field when it was time to talk about her pre-bus routine. My mom cooked dinner and I pre-boluses for it. On Friday I managed Arden's BGs and mealtime insulin from my phone while Cole made the catch you'll see below. Arden changed her OmniPod during a playdate late that afternoon without incident. Kelly returned to our house around midnight and took over the diabetes stuff. I slept that night like a baby.

My Take Away...

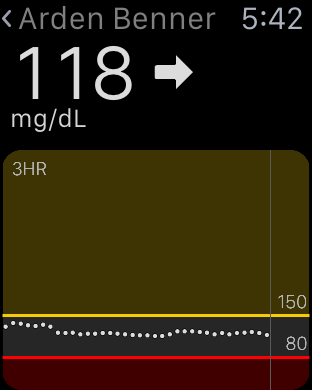

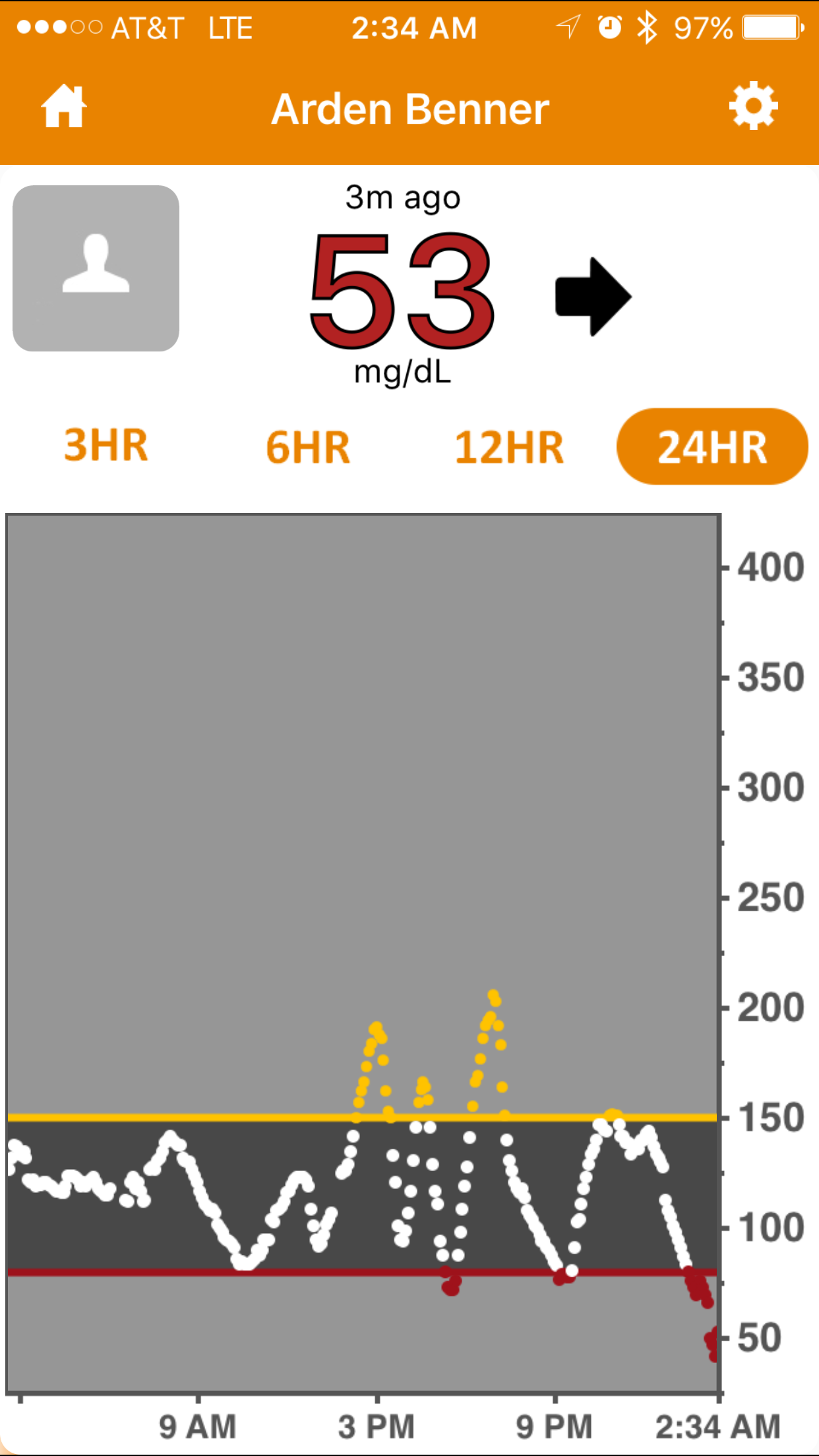

With a reasonable, but not heavy amount of pre-planning, we left our eleven year old daughter at home with a person who had almost no working knowledge of type 1 diabetes and everything was fine. Arden experienced a low BG (53 on Dex, 61 by finger stick) Thursday night around 2:30 am. My Dexcom Follow app alerted me, I called and woke up my mother who in turn woke up Arden and she drank juice as I instructed. I then waited up to make sure that the juice had the desired effect and when all was good about twenty minutes later, I went back to sleep confident that I would be alerted if something changed. In the twenty-four hour period that began at school and ended with that low, Arden's Bg was mostly stable, largely in range and only spiked to 200 twice. Two spikes and one low felt like a huge win to me.

Tomorrow night Arden goes to a sleepover at a friends house, no one in the home has the slightest idea about type 1. We will arrive ten minutes early to install the Dexcom Follow app on the mother's phone, I'll talk about how to handle emergencies and that'll be it.

Your Take Away...

Long run in centerfield. Cole saved a game while in Florida with this catch in the last inning of game 2.

I'm forever telling you that diabetes and fear do not have to go together and I wholeheartedly believe those words. Last week I put my money where my mouth is for two reasons. A. It was the right thing to do for my family and B. I wanted you to see that even in this completely odd and distant situation, things would work out.

I want to encourage you to take a chance too. Who knows, maybe you can move your life with diabetes a bit closer to where you want it to be.

I'll be talking more about this trip and other topics on next weeks episode (#34) of my podcast. If you haven't tried the Juicebox Podcast yet, it is available on this site, iTunes, Stitcher and everywhere else that podcasts are available. Subscribe today to be automatically notified when new episodes are online - It is 100% free.